Restructuring Plan for the “Dr. Simo Milosevic” Institute Revealed: What Changes Are Proposed for This Renowned Health Resort?

The Board of Directors of the Institute of Physical Medicine and Rehabilitation “Dr. Simo Milosevic” has convened an extraordinary assembly of shareholders scheduled for January 9, 2025. The sole agenda item will be the approval of the restructuring plan.

The plan’s conclusion aligns with the EU Conditioning Guidelines on State Aid for entities in distress, suggesting that, based on objective, non-financial criteria, the sustainable operations of the institute are contingent upon state aid.

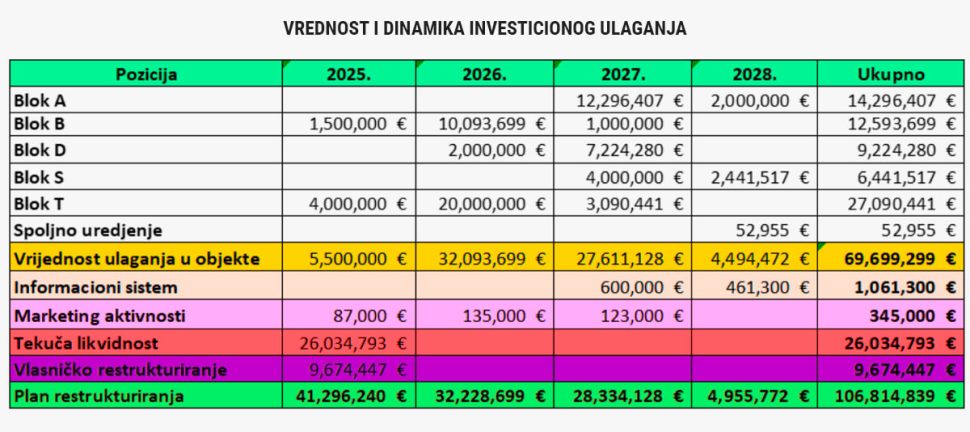

“The total restructuring costs are projected at 106.8 million euros, with 40 percent funded through internal resources amounting to 42.7 million euros and the remaining 60 percent totaling 64.1 million euros.” This encapsulates the key takeaways of the restructuring plan.

The plan, which shareholders at the Institute in Igal will discuss on January 9, outlines a series of steps for implementing the restructuring strategy.

“Considering the essential financial investment required to maintain services deemed of general economic interest in Montenegro, as provided in the restructuring plan, the proposal suggests sourcing these funds primarily through shareholder recapitalization.” This is the recommendation from the plan’s authors.

Regarding recapitalization, the state’s proportionate share is set to increase relative to the amount of state aid, while minority shareholders will not be participating in this recapitalization or acquiring shares from the majority shareholders—the state.

In terms of ownership structure, Villa Oliva holds the majority ownership at 56.47 percent, while it has minority shareholders, including Valeant Pharmaceuticals, which is more commonly known in the region by its former name, ICN Pharmaceuticals, associated with Milan Panić, a businessman and former Prime Minister of the Federal Republic of Yugoslavia.

What does the proposal entail for the Institute in Igalo? According to the restructuring plan, the next steps include:

- Adopting the restructuring plan with a two-thirds majority of shareholder votes. To achieve this, the authors suggest acquiring shares or persuading other stakeholders to join in order to secure the required two-thirds shareholding.

- Facilitating the acquisition of minority shareholders’ shares.

- Following the acquisition of shares from minority shareholders willing to sell, the institute would make a decision regarding the allocation of funds to implement specific measures outlined in the restructuring plan.

- If minority shareholders are disinterested in the recapitalization process, the institute would cover the shortfall in their participation.

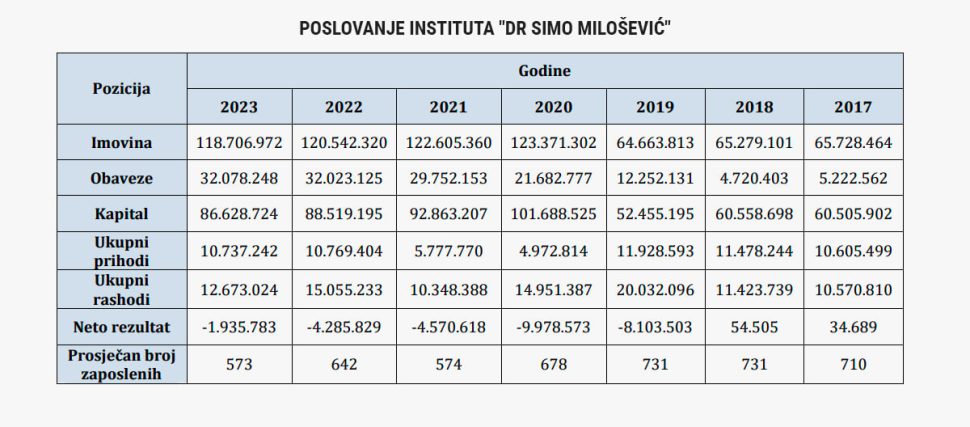

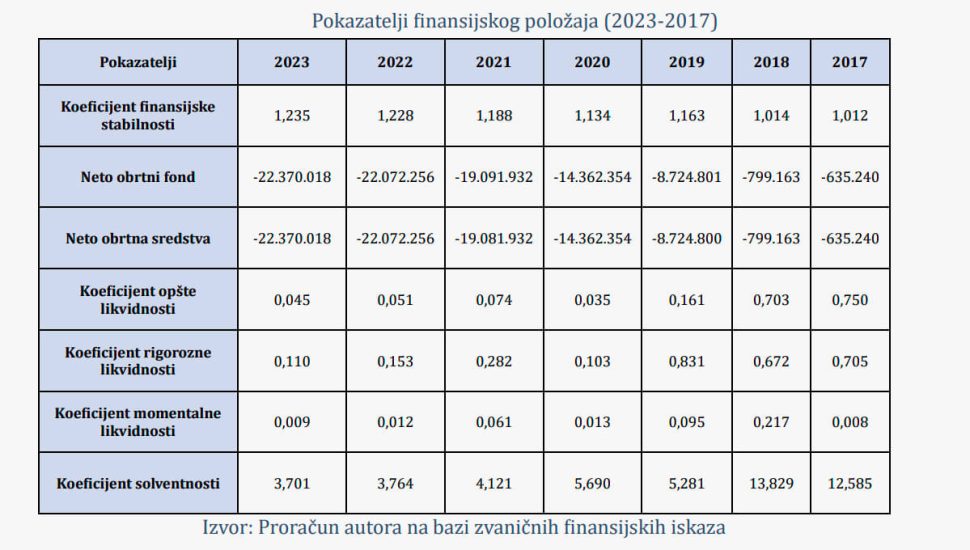

The restructuring plan spans over 270 pages, featuring an analysis of the institute’s current financial condition, indicating serious financial difficulties, challenges in settling obligations, and risks of forced charges alongside low earning potential that raises bankruptcy concerns.

“The only viable alternative (to state aid) in financial management is the sale of non-functional assets or those anticipated to not generate sufficient revenue. This could include the phase and (solitary, main building, and e-block) and the children’s department building. A professional team from the Faculty of Civility has assessed that selling these properties could generate financial resources totaling 28.26 million euros,” the analysis states.

While the sale of real estate could potentially cover the obligations threatening the Institute’s operations, estimated at about 28 million euros, the authors emphasize that the well-known health resort currently lacks the financial resources needed for investments.

“It is estimated that over 69.7 million euros is required for the reconstruction of phase II. In our opinion, obtaining this investment is not feasible, and the institute is unable to secure the necessary funds in any capacity,” state the authors of the plan.

This document evaluates five distinct future scenarios for the Institute, ranging from bankruptcy or reorganization to development strategies in three different phases (asset units) of the Institute, including the potential for a joint venture with a private partner focused on rehabilitation and the reconstruction of four-star hotel facilities.

The fifth scenario, termed “rehabilitation in phase II through the process of disinvestment,” is premised on the notion that the property in question is not resolved, thus it cannot be factored into the analysis or included in the restructuring plan.

“Therefore, the contribution of the Institute, in accordance with legal regulations concerning state aid, must be achieved through the sale of certain facilities currently owned by the Institute as well as through credit financing,” concludes this portion of the strategic analysis.

Within the financial aspect analysis of the plan, two significant points are noted.

One pertains to the need to resolve the issue concerning the transformation of the institute’s usage rights into ownership rights, which could affect its capacity to secure credit.

“If the transition from usage to ownership rights occurs in accordance with decisions from relevant state bodies or through judicial proceedings, the sale of phase and children’s department facilities would no longer be considered,” it states in the plan.

This section elaborates on the potential for the Institute to incur credit debt amounting to 14.5 million euros.

“This loan would be structured over six years, including a two-year grace period, and would carry favorable interest rates. The creditor’s rights would be secured by the Institute’s real estate. This approach ensures that total control over the restructuring plan aligns with state aid regulations,” the analysis within the restructuring plan concludes.